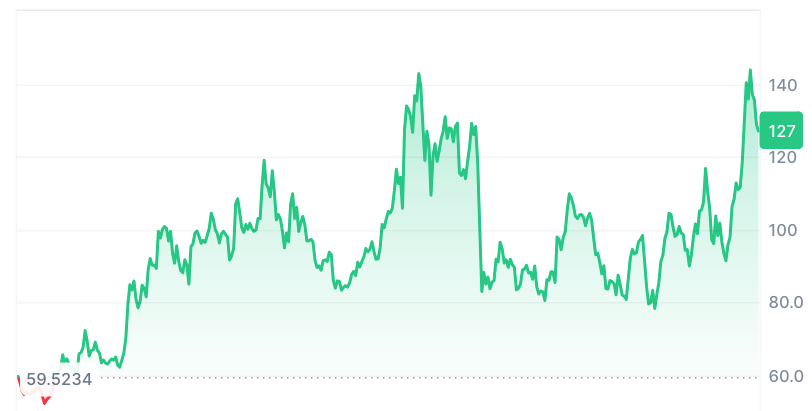

At time of writing, $AAVE is +120% on the year.

This bucks the trend of non-Bitcoin assets generally, which are considerably more flat over the same timeframe. For example, $ETH is only +52%.

There is talk that "fundamentals" are back in style now. For most of the year it was meme coins, but now assets with 'fundamentals' are back in.

I would encourage the idea that fundamentals never go out of style.

In this post I'm going to talk about:

- How to recognize crypto assets with fundamentals

- Why assets with fundamentals will always enter the primary crypto markets first

- How to build a portfolio with these assets.

How To Recognize Fundamentals

What makes a crypto asset have "fundamentals"?

Really, if you can answer why an asset has value within three sentences or less then that's a good litmus test for the asset having 'fundamentals'.

For $AAVE: $AAVE has value because it claims a distribution of the fees earned by the Aave protocol. The Aave protocol earns profits by providing a borrowing and lending service to its users, and charging them a fee for that service.

Simple. To determine if $AAVE is a good investment, look to it's anticipated future revenues versus its current price. And it looks good, by the way. The P/E ratio has never been better - and this is why we see +120% over the past year.

So what are we recognizing? Time-tested characteristics of good investing.

- An asset

- A profiting service

- The asset having a claim on the profits of the service

Primary Markets First

The asset described with those time-tested characteristics is typically going to be a security, by securities laws standards globally.

Don't get the law confused with the regulator. Just because the SEC hasn't gone after Aave's development team doesn't mean that $AAVE isn't a security.

Remember, a security is basically (i) a claim on profits, where (ii) the profits come from the efforts of others.

Is $AAVE a claim on profits and did those profits come from the effort of others? Yep. So it's going to be a security in the eyes of United States' law, which the SEC should enforce but probably won't.

The Aave development team will be aware of this reality to different degrees, but they won't really care because just like Uniswap, Coinbase, Kraken, Ripple, and many others fighting the SEC right now - they're not big fans of securities regulation and are going to continue building useful stuff, despite this regulation not wanting them to build useful stuff.

And in case you're wondering, securities laws are completely incompatible with how crypto works. The only way you can make securities laws work with crypto is by saying, "these laws shouldn't apply". If you want me to write a post explaining why, just leave a comment and I'll do that.

Because of that incompatibility, Coinbase, Kraken, Robinhood, these secondary market exchanges really hesitate to list crypto assets that look like securities. Because when they do, the SEC sues them for being an unregistered securities exchange.

So that's why the secondary markets prefer to list assets that are honestly kind of junky and without fundamentals. That's why Coinbase can list PEPE and BONK without much issue - there's not much for fundamentals there.

It's also why offshore exchanges like Binance and Kucoin just said 'no' to the US market. They want to keep listing better assets, better investments, earlier, and don't want to be sued by the SEC for doing so. The SEC's regulation forces crappy investments onto United States residents.

So if you're building a crypto asset with strong fundamentals, with a good value proposition, and the secondary markets won't take it, where does it get issued? The Primary Crypto Markets.

My team separates the crypto markets into Primary Markets and Secondary Markets.

Some people ask me why we say "Primary Markets" and not "DeFi". My response to that is that DeFi is just the financial tools of the market - it's not the market itself.

For example, when talking about what makes Tesla, Tesla, people don't describe its value as something that is derived from financial services. Tesla derives it's value from the market it exists in. The market is a product line, customers, a CEO, a supply chain, product-market fit, IP, future plans, distribution centres, etc.

In the crypto context, are protocols like Lens, Friend.tech and Farcaster part of "DeFi"? Not really. Do they exist in a market, provide services, and attract value?Are they investments worth looking at? Yep.

So how to describe this market that encapsulates all crypto activity? The primary crypto markets.

Assets with fundamentals are always going to hit the primary markets first. They're going to hit the primary markets first because (a) secondary markets are going to hesitate to list them, and (b) the primary markets are where the assets literally exist. Crypto assets can't not exist in the primary markets.

Now, how do you build a portfolio with these assets?

Primary Market Portfolio

The non-compliance is an issue that either the crypto asset issuers will have to face, or more likely, the regulators and legislators will have to face. I think the latter.

In the meantime, entrepreneurs are going to keep building. As such, you should keep investing. Primary market assets can do very well for your crypto portfolio.

A personal example was $PENDLE, issued into the primary markets in June 2021. $PENDLE was issued by the Pendle Protocol. Can we describe why it has value in three sentences or less?

$PENDLE has value because it has a claim on the profits earned by the Pendle Protocol. The Pendle Protocol profits by charging fees to the users of its service. Its service is the provision of an interest-rate swap exchange, which is a service desired by crypto investors looking to hedge yield exposure.

I liked those fundamentals, so I invested in $PENDLE in March 2023. I saw an all-time return of about 2500%, and am currently sitting at a +1300% gain.

Coinbase plucked up the courage to list $PENDLE in late 2023, but by then most of the gains went to the primary market investors.

Assets like these make your portfolio bang in the cycle; it's how I did 11X in the 2021 crypto cycle.

The average investor, who's doing one to two hours of crypto management a week, can look to allocate about 40% of their portfolio to primary market assets.

The other 60% can be spread amongst BTC, ETH, SOL.

Be careful with any midcaps. At Yieldschool we've had big returns on $RNDR, $GSWIFT and others, but we got into them early in the primary markets.

After these assets get listed on secondary markets, retail investors bloat up the price. Great for us primary market investors, but less so if you're waiting for Coinbase to list it.

Summary

Good investing in crypto, for us, is about the fundamentals.

Most of the same logic you would apply to investing in the traditional market, you should apply to crypto. If you can't answer concisely why an asset in your portfolio has value, then it probably shouldn't be there.

Look to the primary crypto markets for these assets for two-fold reasons. First, because they exist their first and you can get them for cheaper. Second, secondary markets like Coinbase are going to hesitate to list them in fear of being sued (again).

For the cycle upcoming, be self aware if you're someone who is not confident in their ability to research on-chain protocols. If that's you, have only about 40% of your portfolio in these types of assets. The remainder can be left to the blue-chip classics.