Biography

I would consider myself:

- Observant: For periods of 3 months or longer, I have lived in 7 different countries, across three continents. When I'm reading a book, it's typically a biography or a history of some place in time. This gives me the ability to see trends amongst time, culture, and individuals.

- Social: I'm pretty friendly and can strike up conversations with most people. I use the underrated skill of small talk to move someone into an engaging conversation. These days I find myself wanting to dial back my social behaviour to allow myself more time to focus, but I find it unnatural.

- Optimistic: From successes starting in middle school up to my mid-life, I have a belief in the success of any project I turn towards whole-heartedly. Perhaps because I'll only start the project if I think likelihood of success is high (see trait 1). This is why I believe those considering working on my team, or being our customer, should. It's going to make you a winner.

A brief history

How did I become the above? Here's a walk through of my 30-odd years, with an emphasis on study and work.

Early life

I was born to a farming family in East Yorkshire. I understand we had pigs and crops at one point, but then sold the pigs as it wasn't a favourite of anyone. My mothers' father, Gerald Alan, was an avid reader of history. I would say we have that in common. Gerald was apparently able to recollect most of what he read, which I certainly cannot. Peter Hepworth, on my father's side, was 'a farmer through and through', as I've heard him described. He was locally famous for his ability to articulate his views both written and verbally.

Shortly after Peter's passing, my father moved mom and myself to a very small farming community in southwestern Manitoba, Canada. I was seven years old at the time. Memories of this time aren't in a narrative, but instead in strong bursts. A movie I watched 100+ times because I was lonely (Beethoven, the dog movie), or a moment of surprised joy when some other local 7 year olds didn't despise me as I suspected they would.

Despite the funny accent, over time, I acclimatized into the community well enough. I learned that English humour wasn't the same as Canadian humour, and my attempts at being funny drew a lot of bad reactions. So, I stopped trying to be funny - people call me quite serious to this day.

Dad worked various jobs in the agricultural industry in those first couple years. After meeting a like-minded fellow European, they co-founded a farm equipment dealership. The business was a grind for them at the start, I am sure. I have a memory of test-driving a lawn mower in front of one of the first customers and driving it straight into a parked truck. Despite my efforts, that business grew into a successful venture.

School age

I enjoyed school and my classmates. I wasn't much good at the local sports - hockey and baseball - but I still managed to be popular with most people. I'm sure this is because I generally like most people. Whether they were into sports, trucks, girl stuff, goth clothes, horses, or seemingly nothing at all, I liked pretty much all of my classmates. Likewise for those kids in the years above and below.

Being a town of only 1,600 people, the school I attended was a K-12. I attended the same school from arrival at seven years old to my graduation at 18 years old. The people I meet now, professionals usually from big, international cities, are stunned to hear that schools like that even exist.

I was a B+ student. I had a good baseline intelligence, but I was focused on goals even from a young age. I knew what I needed to do to get Honor Roll, my parent's approval, entrance to my desired university. B+ did the trick. Once that was achieved, I could go to things I found more rewarding. My mother did not think the same, enrolling me in extra-curricular maths, piano, and guitar lessons for years and forcing my attendance. The maths practice taught me work ethic, if nothing else useful, and I still play piano to this day.

As a young teenager, I was known for going to older kid parties, sometimes being the youngest one there. My parents afforded me that discretion. Sometimes I made mistakes, but developing the ability to handle myself socially was a real gift. Other hobbies included a serious interest in science fiction, anime (Japanese cartoons), and video games. Less typical for a country boy was my Karate practice. From the age of 12 to 18, I attended a local dojo and trained my way to a 1st Dan Blackbelt. I won tournaments across Canada and accompanied Team Canada to Italy for a world championship, where I earned a bronze medal.

Early adulthood & university

When I attended university, I enrolled in general studies with the plan to move into business school in the second year and do whatever it is that business school students do. The idea of living with my best friend, Jeremy, was terribly exciting. A big city, new friends, the advantages of being 18+ (the legal drinking age is 18 in Manitoba, not 21), and the general unknown is a lot for any freshman.

I remember, more than anything, being ready to prove myself. I didn't know on what, or how, but a healthy ten years of archetypal fiction told me that if you look for an adventure eventually one will find you. During one of my very first seminars as a student, a person who was decidedly not the professor came into the classroom to make a speedy announcement. He stated to the half-attentive students that he had a summer job that could pay $40,000 or more. You just needed to write down your name, email and number onto the clipboard that was being passed around.

The clipboard made its way through the students' hands. Very few of them writing down their names, which struck me as strange. I thought perhaps I had misheard the man. Even though summer had just ended and the next summer was 8 months away, any rational broke university student would obviously want to learn about a $40,000-paying summer job. As the clipboard made its way to me, I saw I had not misheard. The page explained that there was an opportunity where the very top earners had made $40,000 in the last summer. To an 18 year old in 2012, $40,000 was a lot of money.

There were scant other details, but this was a no-brainer for me. Of the class of 100+ students, maybe 7 or 8 wrote down their names. It was a good lesson for me. People misjudge opportunity.

Painting contracting

The high-paying summer job was in-fact a painting franchise business. The franchisor teaches the energetic young student how to run a painting business and the student runs the business over the summer. If successful, the student franchisee pays the franchisor some of the profits. My online research found lots of people reporting this company as a scam, and some in-person research got similar reviews. But the 'scam' complaints seemed more like simple bad-business grievances, and the proposal laid out by the franchisor seemed fair and logical.

It also had risk, which set it distinctly apart from what my thousands of first year classmates were doing. At the time I didn't see it as 'risk', of course, but as 'challenge'.

Unbeknownst to myself until the last minute, there were two very similar painting franchise companies. I had applied to and was being interviewed by both of them, all the while I was thinking it was a strangely disjointed interview process conducted by one. Once all three of us realized what was going on, I immediately received offers from both of them. I went with my gut on what was the better company. The hiring manager told me that there was 'something' to me that made him just 'have to hire me'. Comments like those will stick with you for over a decade.

As painting franchises work, as a franchisee, you get allotted a 'turf'. That is your section of the city to do business in. Other franchisees each get their own turf, and they do business only in that turf. During a pre-summer training session, the President of the franchisor came to visit us new business owners to-be. I overheard the President and the General Manager discussing the problem of not yet having a franchisee to cover the turf next to my turf. Summer was fast approaching, and having everyone in place to get started on sales was important. I walked to the President and asked him to consider letting me run that turf, in addition to my current turf. He agreed. So with a quick ask I just doubled the scope of my business. Another lesson learned.

I went on to be the top earner that summer, breaking rookie franchisee records that stand to this day. I profited $60,000, which was a lot of cash for a now-19 year old with a habit for socializing. I received awards and attention for doing such high numbers, but internally I dismissed these results as a natural outcome of having a turf larger than my peers. The President heard me saying as much at the awards banquet, and quickly dismissed me on it. He said that people who post numbers like mine would do so regardless of their situation. I didn't believe him at the time, but now many years later I've come to see he is right.

The awards and profit were nice, but it was a harrowing summer. To go from happy student to training a ten-man staff in 30 days was a transition. Not just a few homes felt the organizational pressure and disarray I was operating under. The homeowners were often forgiving. Sometimes not.

Ironically, in the craze of that business I almost didn't notice that I had been accepted to the university's business school. That fall of 2013 I attended my first business school classes. I found them very far removed from the business I had just run for the past 6 months.

The next two years were a bit of a blur. In 2014 and 2015 I attended business school, expanded my painting business into general contracting, and used the money I made to travel, party, and have a jolly good time. Cancun, Tokyo, Queenstown, New Orleans, and many other far-flung destinations got a visit from this cash-heavy university student.

By the end of 2015, the limits of running a painting/contracting business in central Canada was apparent to me. I know now that there was still much room for improvement in how I ran that business, but I was right in that it wasn't the challenge I should have been taking on any longer.

I was now entering my fourth year of university. Due to the success of the business and lack of enthusiasm for the academics, I wasn't going to have enough course credits to graduate by the end of the year. My four-year degree became a five-year. While I felt some shame over this, in truth, this was more than fine. For the first time ever, I wanted to do more university coursework and get A's. My goal was to get into law school.

The year prior, a third-year international negotiation course introduced me to the career of an international arbitrator. To help parties resolve interesting international disputes sounded beyond ideal to me. I learned that international arbitrators were, typically, lawyers. So, therefore, I must become a lawyer. After my fourth academic year ended with some of my strongest grades yet, I began the summer prepping for the LSAT (the Law School Admission Test).

In addition to travel, in my second and third years of university I developed the hobby of reading history, philosophy, and culture. From this I knew my fifth academic year must be spent overseas. Hong Kong, I decided.

So began a dream-like 18 month period of travel, discipline, growth, and triumph.

Travel and study

May 2016 to September 2017, this was my life:

- May 2016: Study with iron discipline for LSAT

- June 2016: Travel to Cambridge University for international relations study

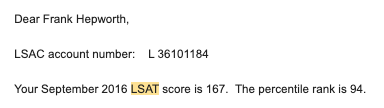

- September 2016: Write the LSAT, landing in the 94th percentile

- January 2017: Hosted by friend in Mongolia

- February 2017: Begin studies in Hong Kong

- June 2017: Begin internship at top law firm in Shanghai

- August 2017: Return to Canada

- September 2017: Begin law school on an entrance scholarship

Never before had I stuck to a routine like I had for my LSAT. Diet, sleep, habits, phone use - I monitored everything. I know now that nothing ensures discipline like a clearly-defined, time-allocated goal.

When my mother suggested I go study an international relations course in Cambridge for 3 weeks in the summer, I almost said no. It would be too difficult to maintain my LSAT prep routine. But, with the painting business folded, I did indeed have the time to both go to the UK and prep thoroughly for the LSAT to spare. It was well worth it.

At Cambridge I stayed at Selwyn College, one of my first encounters with man-made beauty. For those three weeks I read about international conflict, genocides, and nation state history. I recall my self-study happening in small, peaceful libraries that were centuries old. The sense of peace one has in a study like that is a feeling I would would wish to give everyone if I could.

One aspect of the international relations program that I did not expect was the wild pack of Australian/American/Indian students who were also enrolled. For them, this was an easy excuse to get extra credits for university back home while also travelling the UK.

Despite the near-magic sanctuary that was Selwyn, those Australians that composed the bulk of our group were the highlight of the trip for me. As with highschool, I found myself liking all of my classmates. I remarked at how different they were as individuals, and yet all had these common Australian characteristics that complemented their individuality. I've never been to Australia, but I'll speak well of it to anybody who will listen. Good people come from that country.

After Cambridge and visiting family in East Yorkshire I hadn't seen in many years, I returned to Canada. When I fell back into my same LSAT prep routine, I noticed a difference. A lot happened in Cambridge, and it changed me for the better. I became excited for what travel to Hong Kong would bring.

Despite monk-like discipline for the four months preceding, the night before my LSAT exam, my roommate had a serious mishap that caused me to be up late into the evening. I went into the LSAT at 8am Saturday morning on perhaps 3 hours of low quality sleep, emotionally frazzled at the turn of events. I felt cheated and annoyed, to say the least.

But, as it turned out, I had drilled myself hard enough those preceding months. Even in a zombie-state I was able to get the results I was needing, landing in the 94th percentile of test takers.

I spent September to December in Canada, and on December 28th, 2016, I flew out to Hong Kong for my semester abroad. This was the final semester of my five-year business degree.

Hong Kong's academic term starts in February, and so I spent most of January 2017 living in a tiny apartment as a local would. I love Hong Kong - it's possibly my favourite place on the planet. With its colonial history, much of its social culture is actually western. Small mannerisms between people are not so different as what we would expect in the West, and sports like tennis, soccer and rugby are the most popular. Two centuries of wealth accrual have made the city luxurious and global. And of course, because it is a tip of mainland China, Asian culture dominates through the cuisine, language, spirituality, and architecture.

After being in "HK" for only a week, a friend of mine, Muugii, messaged me to say he had returned home to Mongolia and I should come visit. I had become friends with Muugii in 2015 through a volunteering program in Canada where English native speakers get paired up with new arrivals who need English language practice. I respected Muugii immensely as he had a wife and two young sons waiting for him back in Mongolia while he tried to make a better life for them in Canada.

Mongolia is a harsh country in January. The capital, Ulaanbaatar, is the most polluted and coldest capital city in the world. Going to it without the support of a local is difficult. There's little convenience, little English, and little to do as a tourist. What's more, the air gets so yellow with smog that public transport becomes hazardous to your health because of the time spent outside. The cold was serious, -25C to -45C every day, and protests are held each year by people affected by the pollution.

But because I had my local, Muugii, I had a private vehicle, I saw Mongolian wild horses, I ate meat with nomadic ranchers, I visited temples and mountains google maps did not know, and I drank Russian vodka with local club owners who had us in good favour. It was a proper trip that left me feeling like a local, not a tourist, and gratefully exhausted.

I returned to Hong Kong to attend university for the last semester of my undergraduate degree. I had good intentions of being a diligent student, but the things to do and the people to do it with were too interesting to ignore. Again, I found myself liking pretty much everyone I was meeting at the university.

The Hong Kong University of Science and Technology (HKUST) is about a 35 minute drive from the main city of Hong Kong. It is a highly-ranked school, with a sprawling campus built on top of rocky forest that faced the ocean. It is a beautiful place and a self-contained ecosystem. It even has its own McDonalds. I particularly like the outdoor swimming pool and running track. In the 'winter' months of Hong Kong, the weather is actually amazing. It allowed for hikes, late nights out on the town, walks by the beach, rugby games, and much more, every day of the week.

My semester abroad had two big impacts worth sharing here.

The first is that it made me very aware that there are levels to society, wealth, and competency. As an international student in Hong Kong, you could attend galas, conferences, and request dinners with notable and wealthy people relatively easily. It's much different to being a tourist, where you simply see 'attractions' and then leave.

Over that semester I met young professionals who were smart, wealthy, and sharp. The pride over my painting business dissipated in comparison to what I was seeing and who I was meeting. I met self-made men wearing my business' annual revenue on their wrist. This humbled me.

The second moment of influence happened February 6th, 2017, at about 10am HK time. Tom Brady brought the Patriots back to beat the Falcons 34 to 28 in overtime. I'm not big into the NFL, but I had already made fast friends with some American students who naturally were. A testament to Hong Kong's international entertainment, we were in a packed British Pub watching the game at 7am on a Monday. When the Patriots made the comeback, Andreas, still my friend to this day, lost his bet with me and owed me $100 USD. Going from USD, to Hong Kong Dollars, to Canadian Dollars, turned the $100 into about $50 from fees, plus it would take two hours of messing around with ATMs and banks. Instead, Dre offered to send me ETH. And so I accepted my first crypto asset via self-custody in that British-themed Pub.

In February I also found out I was admitted to law school. With that concern addressed, I could maximize my time in Hong Kong and Asia generally. I travelled to Macau, South Korea, and China multiple times. As I became aware of the influence of China on Hong Kong, I started studying mandarin every day. I was doing my best to steep myself in everything Asia. From what I was seeing, the region was going to out-work and out-engineer North America in the decades ahead.

By May I knew I'd rather spend the summer in China than Canada. I lucked into an internship with Dentons' Shanghai office for the 2017 summer. Dentons is one of the top law firms in the world, and getting to spend 3 months in their premiere China office was a stroke of luck. In Shanghai my mandarin continued to improve, and I saw just how hard all strata of Chinese work. Construction sites would have men at work 24/7, literally. I recall coming home from the bar 3am on a Sunday, and the welding and hammering continued.

And it wasn't just the labourers. The lawyers in my firm were making excellent salaries, and would have been the top 0.1% (top 0.001%, even) of law students in their time, but I'll be damned if they weren't working 12, 14 hour days still. It's a theme I've seen again and again - if you're doing the same thing as the crowd, even exceedingly well, it's going to be a tough slog for you.

Shanghai was an amazing city. It is China's global city, and has much in common with Hong Kong. The difference is that Shanghai's international influence is only surface deep. There's lots of international bars, restaurants, entertainment and the like, but it's still Chinese in its law, institutions, and culture. To a westerner, it is less familiar than Hong Kong.

It was August 2017 and my time for Asia was up. I had to go back to Canada and begin law school, which I was excited for. I had even earned a scholarship, meaning most of my first year was paid for. It was awarded to the first-year student with the most diverse and well-rounded application, or something like that. Basically, the scholarship for the student whose grades were good but CV was awesome. I wasn't in need of the money, but I took it gratefully. I appreciate the Dean for thinking highly of my application.

Law school & more

September 2017 to June 2020:

- September 2017: Begin law school

- May 2018: Work in Leer, Germany

- August 2018: Travel Beijing, Xi'an, and other Chinese cities

- September 2018: Begin second year law school

- May 2019: Summer student in Calgary, Canada

- September 2019: Study final year law in Shenzhen, China

- January 2020: Return to Canada

- June 2020: Begin full-time role at BLG LLP in Calgary, Canada

The first year of law school was boring. I was very aware that what I was learning was localized to one jurisdiction, one country, at one point in history. While some of the common law was indeed 500+ years old, I found what I was learning was quite idealistic and not how the world actually worked. I had difficulty taking it seriously, which made me feel strange. When I looked around, my classmates were taking their studies incredibly seriously. I wanted to say, "you guys know this isn't real life, right?", but I didn't because I was sure I was in the wrong, that our studies were about 'real' things and my appreciation was simply shallow.

The good thing about law school being boring was that it allowed crypto to become very interesting to me. The 2017 bull market was in session. I was barely participating, but I studied my ETH, Bitcoin, and the other assets of that cycle increasingly. In what most will scoff at, I found something very real about crypto that the laws and regulation I was studying at the time did not have.

One thing about law school that I did enjoy is that it is very competitive. Students are ranked against each other on exams. With those rankings, the students apply to law firms. The law firms hire the best ranked.

There are three main times to apply to law firms and get hired. First, is in your first year. Few students get hired at this time, and the ones that do are exceptional. Second, is in your second year. Most 'big law' firms hire at this stage, selecting maybe 25% of the 'best' students. 'Big law' is the term for the large national law firms that pay the best salaries. In Canada, there's roughly 8 of them, depending who you ask. The third time to apply is in your third and final year. This is a tougher spot to be in, as it begs the question why you didn't get hired in the first or second year.

Naturally, the sooner you can get hired, the better. I applied to far flung firms in my first year and did not get hired by 'big law'. Even Dentons in Canada did not pick me up, despite my internship in Shanghai. The disappointment of that wasn't severe. I can't recall if a single first year student from my school got hired by big law that year. The disappointment also didn't last long, as my dream first-year job landed in my lap by happenstance. The Chief Legal Officer of a German international shipping company, while visiting his partner in Canada, swung by our law school to find a clerk to come to Germany for the summer and help manage arbitration files.

It was a well-paid, international, legal-field job, where I would work on arbitration files. I could not believe that such an opportunity existed for a first year student. I interviewed well, and got the job. Out of 200+ students, maybe only ten to twelve students applied. With the dream summer job secured, the rest of the academic year was spent studying law, mandarin, and crypto. Quite the combo.

Summer arrived, and I hiked to Germany. The legal department was somewhat of a sitcom. It was a Canadian (me), an American from Tennessee, a German and a Belarusian. While the personalities were exceedingly different, all except the Canadian were highly competent at their work.

I found the work lacklustre. This was jarring for me at the time, as my goal for the past four years was to work in international arbitration. Here I was, working in international arbitration, and it wasn't what I imagined. I imagined big boardrooms, big egos, and emotional business magnates. In my head, we would have started each meeting with curses, finger pointing and much drama, until slowly but surely, each party would eventually fawn over my good humour and virtuous character and we'd reach a settlement where we would all agree that the compromise arrived upon was the true equitable outcome.

In reality, the parties type up documents up to 100 pages long and email them to you full of invoices, diagrams and schematics of ships and their cargo, arguing their case. You read all of it and make a decision. You'd then make your own document, explaining your reasoning. You'd email it out, and that would be final. No discussion. The participants would either accept or would appeal your decision to another arbitrator, and the process would reset but with the additional complexity of considering the first arbitrator's decision.

It's important work, and must be done. For my personality and changed interests, it wasn't right for me. I was fully into crypto and China at this point.

That Chief Legal Officer, Ed, was supportive of me as a person. He is a good leader. He gave me the last summer month off from the job to go travel China, something he knew was important to me. I travelled all over China, to far-flung locations that don't even look like China. I also visited friends I had made the previous summer in Shanghai and sought out anything I could find related to crypto, which wasn't much.

Back in Canada I began my second year of law school, and this was the year to get hired by 'big law'. It was difficult to focus on this, as my interest in crypto was now boiling over. For those who recall, late-2018 was the depths of the bear market, but my increasing understanding made me exceedingly confident the market and innovation would return in 2019. I was reading core texts on Bitcoin, determined to understand the tech as deeply as I could. On my cover letters to the law firms, I was explicit about my interests in crypto and blockchain. Now knowing what I know about big law, that was perhaps the worst thing I could have been doing for my application. But, c'est la vie.

I was hired in that second year by a 'big law' law firm called BLG LLP, which is actually Canada's largest law firm. They were my top choice as their Calgary office specialized on mid-market industries, of which blockchain is included. I think I was a top choice for them, too. Going into that summer of 2019 I was determined to do as much crypto-related work as possible. In the spring I had put most of my remaining money into Bitcoin, scooping it at the USD$3,000 price range. Don't ask me about my conviction in the asset class - I was buying when no one else was.

Being a summer student at a big law law firm is a great time. You don't have real work to do, you're more-so there to entertain the associates and partners and learn what life in the firm is like. It's a blessing when the other summer students are good people, too. My cohort was full of them.

I was definitely the 'weird crypto kid' of the group, and I was very pleased with that. I wanted everyone to know me as exactly that. When a crypto file came across their desks, I'd want them to immediately think of me.

The summer was largely uneventful, and fun. My fellow summer students were much like myself, and we got along well. In a rare return to form, I hosted a party so good that it was the talk of the whole firm the following week.

As with my experience in Germany, I do recall not feeling excited with what I saw in the firm. The lawyers were elite, hard working individuals, and the work they did was high quality. But as with Shanghai, these people worked long and hard, on tasks that didn't strike me as particularly important. It's necessary work, it must be done, but to me there still seems to be a mismatch between the cost and effort put into lawyering work and the impact it has on real-world outcomes. Though, now as a business owner who needs legal work done, I will say I'm coming to have some of my earlier views changed.

After that summer, I began the third and final year of law school by exchanging to Shenzhen, China. The motivation was simple: go to a city where there is a law school, crypto and mandarin. Shenzhen's Peking University campus is a highly regarded school, and the city itself was gaining notoriety for being an underground crypto hub.

Upon arrival, I immediately started attending crypto events. I would introduce myself and my goals, and soon enough I was told to visit a local lawyer who was known to work with crypto clients.

This lawyer was the leader of a crew that I found hard to trust. They were too involved in the crypto deals they worked, and the deals I saw looked sketchy. However, they were the best insight I had into the underground crypto scene of Shenzhen and so I stuck with them. When they toured eastern China to meet government officials, I toured with them. When they went to Bangkok, Thailand to host a crypto investor meeting (that wouldn't have been allowed in China), I went with them. I'd like to think that they took me along for my expertise on the subject matter, but I'm sure it was because a caucasian in a suit lended legitimacy.

After two months of this, I realized that the legitimate projects and clients weren't coming. It would take me a while to realize that good crypto projects are found online, and not in cities like Shenzhen, New York, or Dubai. Interestingly, in 2019, Shenzhen had a lot of focus on the e-Yuan, China's Central Bank Digital Currency. I read everything about it at the time and formed the belief, early for the time, that CBDCs will be one of the most transformative technologies of the 21st century. The tech is neither good nor bad, but it will be powerful.

After Shenzhen, I returned to Canada for the start of 2020. I joke that I was patient zero; it was through me the first covid entered Canada. Much of the West locked down in those months, and my law school career came to an anticlimactic end. Classes were transformed into either pass or fail, and my Chinese grades were transformed the same. So with a year's worth of 'pass's, I moved back to Calgary in 2020 to begin working with BLG LLP full time.

Working as a junior in a law firm during covid had its pros and cons. The con was that a lot of informal mentoring that could have taken place, did not. The pro was that I was able to keep more time to myself, which I put towards studying and investing in crypto.

Law practice and investing success

2020 and 2021 were big years for me. On the investing side, I drew opinions on which crypto projects would do well. My research and understanding of regulation taught me not to trust 'real-world' tokenization projects, and instead invest in assets where the team was capable and the operations were mostly or entirely on-chain. Assets like SOL, AVAX, and AXS did me very well, pushing my portfolio to seven figures. Despite the workload of a junior attorney, I managed to get ahead by simply getting up earlier and working harder. I would get up at 4:30am and stream myself live, researching crypto. I called these live streams the "4:30 Crypto Club". I think at it's height I had four live viewers. Here's the welcome video I filmed but didn't release.

On the lawyer side, my experience was also exceptional. Because of the bull market and our firms' deep financial regulations expertise, crypto-related clients continually chose our firm to service their legal needs. As I had spent the previous summer shameless promoting myself as the weird crypto kid, I was now being sought after for the crypto files. I worked on more advanced projects, took on more complex tasks, and sat at the table for discussions I otherwise wouldn't have been privy to.

I went and worked physically with crypto exchange clients for months, I drafted token-offering documents for clients I sourced (my clients, which is unheard of for a junior), and negotiated against the Alberta Securities Commission (good guys) and the Ontario Securities Commission (bad guys), amongst a lot else. Through two years of non-stop work, I got very familiar with how our financial regulatory environment is set up in Canada and the United States (it's quite similar). I also gathered insight into why, when, and how securities regulators make their decisions.

By 2022, I had a good enough understanding of the intersection between crypto and our western regulatory structure. I began to understand that there are core incompatibilities that would not be easily overcome. And I began to think that one will gain to the other's detriment... I started considering leaving the regulatory industry (law), barely two years into it, to focus on whole-hearted crypto work.

Social media

Before I made the jump, I wanted to make sure that, basically, I wasn't crazy. I decided that my litmus test would be my ability to understand and communicate with the crowd. I thought that if I could create social media content that is well received by crypto-interested users, then I should be able to create a service that is well received by a crypto-interested market.

I think this is actually a very good test. If you, the reader, are thinking about starting a business, try creating social media content for the target market first. If the content does well - good job, you are in-tune with your target market. That is a green flag to continue. If your content flops, there is something you don't understand. Figure that out before sinking the capital to sell something no one wants.

I chose TikTok as the platform to test out my content. I chose TikTok because the algorithm seems by far the most responsive. Good content does well, and bad content does not - immediately. This is different from YouTube, where quality content can go undiscovered by audiences for months and even years.

Thankfully, my content did well, immediately. My very first video has almost 30,000 views. I had the authority of being an attorney, and my ability to explain two opposing topics, regulation and crypto, with synergy proved to be viral content.

After three months of continual success with the account, I knew that my idea for what would prove a useful service for crypto investors was legit. And with that, in the summer of 2022, I launched Yieldschool.

Yieldschool

In 2022, I knew three things:

- censorship-resistant decentralized networks now exist

- entrepreneurs continue to access and build on these networks

- traditional financial institutions only service censored markets

Consequently, traditional financial institutions will not service the entrepreneurs (or their investors) who exist on censorship-resistant decentralized networks.

I thus recognized the need for a service that helps people responsibly invest into the genuine innovation taking place on decentralized networks. Whether it's Ethereum, Solana, Shibarium, or whatever - if someone only has one to two hours a week to figure out their crypto investments and the traditional institutions won't help them, we would step up. And we'll get so good at it, that when the traditional guys finally start, they're going to be nowhere near as good as us.

But that's a lot of work for one guy. There's a reason the traditional finance sector constitutes 5% of the economy - it takes a lot of humans to research and help clients invest in the other 95%. So, I started with something more specific.

It was mid-2022, the depths of yet another bear market. People were jumping out and I was jumping in both feet. Asset valuations were going down across the board. One area of the crypto market that was still paying better than traditional markets were stablecoin liquidity pools. Essentially, tools that paid 15-35% yearly interest on cash. Like a GIC or CD, but more risk-on and crypto version. The industry term for interest paid on liquidity is 'yield'. It was fairly complex to get this yield - there was no app you could just download. So the first iteration of Yieldschool was a simple program covering how to earn yield. Yield, school. Simple as that.

The first sales for Yieldschool were made through my TikTok. I did USD $30,000 in the first month. I was so happy, I remember fist pumping in my apartment when I woke up to see the first sales. I was flying high, thinking that I had replaced my lawyer's salary in just a few months doing something with much greater growth potential. Inexperienced as I was, I found out quickly that organic sales are inconsistent. 'Organic' is social media content that you post normally and for free, while 'paid traffic' are the ads that you pay Meta, Tiktok, etc. to run and place in user's feeds. Those first month's successful sales were from TikTok followers who had built up loyalty to me over the previous 9 months. After that first month, sales really slowed down.

At this time in late 2022, I was in Thailand. I left Calgary as my network there was all lawyers and accountants. Good friends, but not the right group to have around when trying to do something risky. In Thailand, a digital nomad hub, I thought I would naturally bump into people who could help me with the business. I was right. In short order, I met a 20 year old kid who had quit university in Melbourne to travel to Thailand and build his marketing skillset. We became friends first, and then realized that we could work together. It took a while, though. He had his own clients at the time, and I hadn't yet realized that organic sales were going to be so inconsistent.

By mid 2023 it clicked that we should be working together. Yieldschool needed to run ads ('paid traffic'), and I could tell he was a natural talent for making ads. On queue, the crypto market was rebounding as I knew it would. I quickly recognized that showing how to make 30% yield on cash wasn't as important for our customers (now 'Members') as making 500%+ in non-cash crypto investments.

And so I started expanding our yield service into a comprehensive crypto investment service. On sales calls I spoke with hundreds and hundreds of investors. I know what the crypto investor wants and needs - and they're often not the same thing. After doing an 11X on my portfolio 2019 to 2021, I know how to invest in crypto. Building a service that gets our Members to that outcome is pretty easy. Crypto is the fastest growing asset class in history, and it repeats every few years. It's not rocket science.

We know there are a lot of crypto assets. A lot. Most of them are junk. But a select percentage of them are built by some very capable teams and are very compelling investments. And you, the investor and reader, know this is happening. So you ask your financial advisor about these assets, and he replies that "it's not our thing". Not to be put off, you decide to do some research yourself. To your mutual satisfaction and frustration, there is a lot of information and opinion about this stuff online. Again, most of it is junk, but there is quality information there. It takes you a few hours to find the quality info, and by the time you do, you're out of time. You have work in the morning. Tomorrow you return to that information, but the information is complex. And maybe it's missing some important bits you are wondering about? You wait for the weekend to suss it out, when you have spare time. The weekend comes and goes. You spent it with family and friends, which you can hardly regret. But annoyingly, prices went up 10%. You missed out on those returns because you didn't get the research done earlier. You avow to research better next week and make some decisions. Next week comes, but a different asset has your attention. How does this one compare to last week's interest? You didn't research the one last week, so it's hard to compare the two but you feel you should have the full information before you invest. Do your own research, right? By the weekend, you find you still didn't invest. But it's ok, markets dipped 5% and you are sheepishly relieved that there is less pressure to do research this very moment. You don't utilize that time, and markets rise 15% by the end of the week. This continues for four to five months, and markets gain nearly 100%. You made some small investments over that period based on your half-information from some videos you watched, but some frustration has also piled up. You could have doubled your money already if you made bigger moves, earlier. You make a couple big moves now, to prove to yourself you can change your habits. Markets retrace 30%. Now you need a 42% gain just to get back where you were. This is painful. And with 30% less money available to make gains with than you had four months ago, you find it difficult to find the motivation to get to the daunting task of research.

So ^ that ^ situation is the one Yieldschool solves. We give investors the best quality information on how to responsibly build their crypto portfolios and maximize their returns from the asset class. Good crypto investing is simply investing in quality projects, early.

We do this by focusing on the software itself, not the charts. Warren Buffet would hate the analogy, but we think we invest like him. We want to see software that is delivering a service that is accruing value, and we want to invest in that. We think that "real-world assets" and "AI" narratives are half-baked and ultimately a misdirection. A good investor knows opportunity comes from any market, and bad investments abound in label-caused bubbles. Instead, investing in software and assets that are entirely on-chain is the correct approach. This is why no RWA projects have delivered long-term results, while entirely on-chain projects like Pendle have returned 3000%+ since we invested. There are exceptions, and those are often highly profitable, but our core thesis is the above.

Day trading, memecoins, algo bots and the like are all tools to dump on retail investors who are none-the-wiser. Instead, we advocate building a responsible portfolio of assets that are underpriced by the market, holding them, and then eventually selling them after the thesis proves out. Again, it's not rocket science, and it works. Traditional finance private equity firms don't make their 50X returns from day trading or algo bots - they make it from good investments in early stage businesses. The same applies for crypto - it's just that the business you invest in is different.

We're going strong now, with a team of 16 professionals managing a Membership that grows daily. Our year-on-year revenue has increased by over 2,000%, which is not too shabby. Costs have increased as well, naturally. Serious crypto analysts who create concise action plans for our Members that return high multiples are not cheap individuals - nor should they be. And that's why our Members are happy to pay us; valuable information isn't free.

Goals

Right now, most of my waking hours are spent on building and improving Yieldschool. We have 100% conviction in the asset class and the infrastructure.

One thing I observed in my father with his business was overwork. His 7am to 8pm dedication had a serious cost, and I am trying hard to force restraint on my working hours. Not to relax, or find work-life balance, but in appreciation of the fact that the best creativity and problem-solving comes out of restraint. If I can always just tag on another hour of work, there's no need to think of a better solution.

I know I want Yieldschool to have a big impact on people's lives. I know our Member's aren't looking for that, they just want to make money. And that's great - we'll get them that, that's easy. But I do believe that in an age where the rate of change is increasing, we can buffer our service with time-tested principles. Truth, rationality, compassion. The short-term consumer is ruthless, but I think we can keep their business by being good people with good service. We'll see.

Wrap-up

I hope you now know a little bit more about me and why I do the things that I do! This list wasn't exhaustive—I've began a variety of other businesses, and had a handful of other jobs —but none were particularly remarkable and I wanted to keep things focused to highlights.

It goes without saying, but omitted here are a tremendous number of personal and professional relationships I've made that have shaped my worldview considerably.

One important thing I learned about myself while doing this exercise is how much each of my 20's milestones revolved around individual efforts in specific places. It is only now where my achievements are becoming dependent on people. This is a big improvement. It is painfully obvious to me now that I can achieve more with others than by myself.

If you'd like to contact me, to become a Member of Yieldschool or otherwise, send me an email at frankhep@yieldschool.com. Please follow up if I don't get back to you (I get a lot of spam).

Other miscellaneous facts about me

- I love music. I can hear an artist once and recognize them in any other song.

- My favourite book series in the teen-fiction series, Airborn. At ten years old I skipped school and hunted down the author, Kenneth Oppel, at a private conference for librarians. I got his signature and got to sit at his table for the event dinner.

- 我的中文还不错 - 如在中国两三月,再流利差不多

- The town I grew up in is Boissevain, Canada.